Most large banks now offer highly secure, sophisticated online banking. You can still go to your bank branch as normal, but internet banking adds the convenience of accessing your account and making transactions whenever you like and wherever you are.

These are some of the things you can do using online banking:

- view your account balance, interest rates and any fees

- check your latest transactions and statements

- manage direct debits

- make payments securely or transfer money between your own accounts or to other people’s

- check, change or cancel any pending payments

- report a lost or stolen card

- order new cards, PINs, chequebooks and statements

- update your personal details and security settings.

Fraud

It is natural to be concerned about fraud, however, the banks now have strong procedures in place to monitor for this in the real and virtual worlds. By seeing how you normally use your account, they will alert you if anything out of the ordinary happens e.g. if your card looks like it’s been used abroad or an unusually large amount has been taken from your account. They will usually act quickly and, whereas, in the past, it would have been up to you to prove the fraud, they will take the initiative and usually set things right. As a consequence of this, they may sometimes query a legitimate transaction you are making so you will just need to confirm that this is fine.

Security

You will be asked to create a password for your online banking account. This should be something memorable to you but not something anyone else might easily guess. It is strongly recommended that you have a completely different password for online banking i.e. not a password you also use for other websites. Also, avoid choosing something which the bank might use as a security password to verify your account e.g. mother’s maiden name or the first street you lived on.

It is extremely important that you do any online banking using a secure wi-fi connection and in a private place so that strangers can’t see your personal details. It is best to avoid doing your banking in a café or any other public place.

Always remember to sign out of your online banking account (‘Sign Out’ is usually found in the top right hand corner of the screen) when you have finished, even on your own devices.

Joint accounts

Different banks will have different rules regarding online banking for joint accounts so it’s best to check or look on their websites for exact details.

Banking Apps

Most banks will also have apps for mobile banking which you can install on your phone or tablet. Remember to only do this on a secure internet connection.

If you use Apple (iPhone), you will find your bank’s app in the Apple Store.

If you have an android phone, it will be in the Play Store.

Registering

The registration process will be similar to the process for websites.

What you’ll need to register:

- a computer with a secure internet connection

- a bank account

- your bank account details, such as bank account name, number, and sort code

- debit card details (if you have one)

- possibly a mobile phone and/or email account you can access

- a PIN code or security password which the bank might have sent you in advance

- to be aged 16 or over (but this age limit can vary from bank to bank).

Step 1: Go to your bank’s website. If you don’t know the internet address (url), type the name of your bank into a search engine such as Google and click on the link that appears. For this example, we’ve used NatWest. You will get a search result which looks like this:

Click on ‘Online Banking’

Step 2: You will be taken to a new screen which explains more about online/mobile banking and its main features, which may look something like this:

Most banks and building societies have guides and videos explaining how to sign up to their online banking services. Links to these are listed at the end of this guide. These links all begin with ‘https’ – the ‘s’ at the end means these sites are secure.

![]()

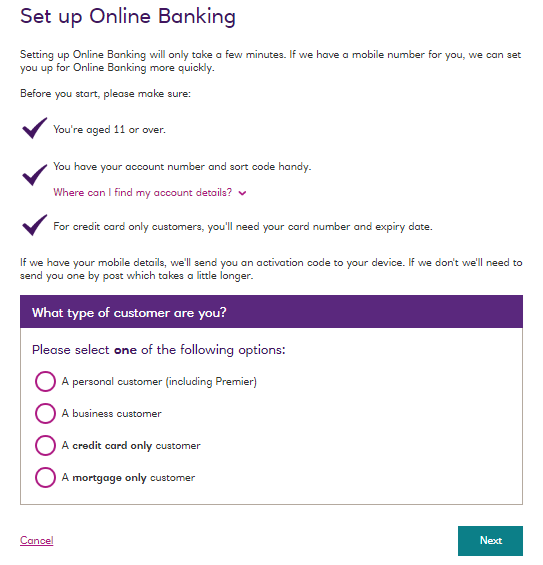

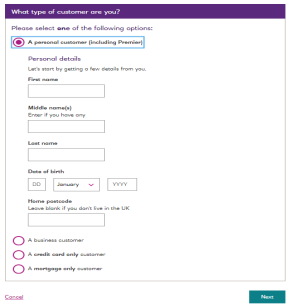

Step 3: Banks will have slightly different processes for registering but you will broadly follow these stages:

Complete a form for your personal details:

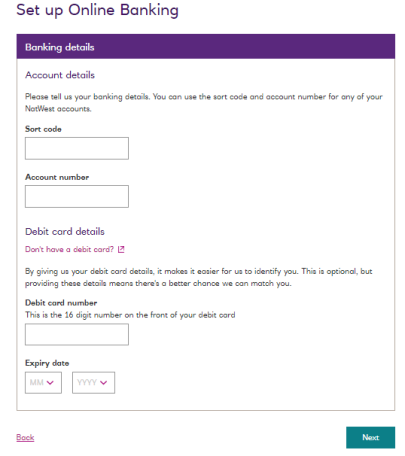

Complete a form to give your bank details:

Complete some security details:

Once you click on OK/Next/Continue, a new page will open welcoming you to online banking and confirming your details. You may also be able to choose at this point whether or not to receive paper statements and other information. If you’re happy to proceed, click OK/Next/Continue.

Note: You may be able to proceed or you may have to wait for confirmation from your bank with a customer number for online banking.

You may well receive a welcome email with a verification link which you need to click on. These links expire after a certain period so it’s a good idea to check your emails soon after registering.

Once you verify your new online banking account, you will be able to use it.

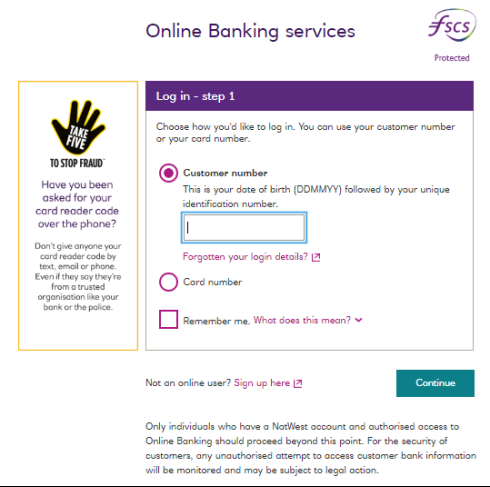

Logging in

You can return to your online account at any time. Just click Log In at the top of the bank’s home page. To keep your account safe, every time you log in you’ll be asked to enter several details, such as your customer number, password, PIN and/or date of birth. Add these in the boxes provided. Once logged in you’ll have access to all the online banking services.

Your bank will look different to the example shown (unless you’re with NatWest) but you can see how online banking might look once you’ve logged in. You can click the different elements to access them.

Important – Once you’ve done your banking, don’t forget to sign out of your online banking account! The link to sign out is usually in the top right hand corner. Alternatively, you may see your name displayed in which case, click on that which should then give you a sign out option.

This guide from Compare the Market provides a great overview of managing your money online https://www.comparethemarket.com/credit-cards/content/digital-money-for-seniors/

Links to online banking for major UK banks

Lloyds https://www.lloydsbank.com/online-banking/how-to-register.html

Santander https://www.santander.co.uk/personal/support/understanding-our-services/online-banking-guides

HSBC https://www.hsbc.co.uk/register/

Barclays https://bank.barclays.co.uk/olb/registration/registerAppContainer.do#/get-started

TSB https://www.tsb.co.uk/help/online-banking/

Halifax https://www.halifax.co.uk/aboutonline/register/

Last updated 4th April 2024